“The first lesson of economics is scarcity; the first lesson of politics is to disregard the first lesson of economics.”

By Thomas Sowell

Canada´s National Debt and Accumulated Interest Payments

This is my second of three Economic Prosperity posts.

In my first post, Canada Is No Longer Economically Prosperous, I presented the case for why I believe this assertion is valid.

In this post, I present evidence to support this assertion.

In my third post, How Federal Debt Impacts Provinces, Territories, and Canadians, I outline how our current economic state directly affects Canada and, most importantly, its citizens.

Using these three posts as a foundation, I will be turning my focus toward five categories of posts — Economics, Political Governance, Public Sector, Private Sector, and Canadian Society — which will delve deeper into the underlying causes undermining our economic prosperity. I will also propose potential solutions to address these impediments. Canadians deserve to live, prosper, and grow old once again in this wonderful country of ours.

Canada´s National Debt and Accumulated Interest Payments

In my inaugural article called Canada Is No Longer Economically Prosperous

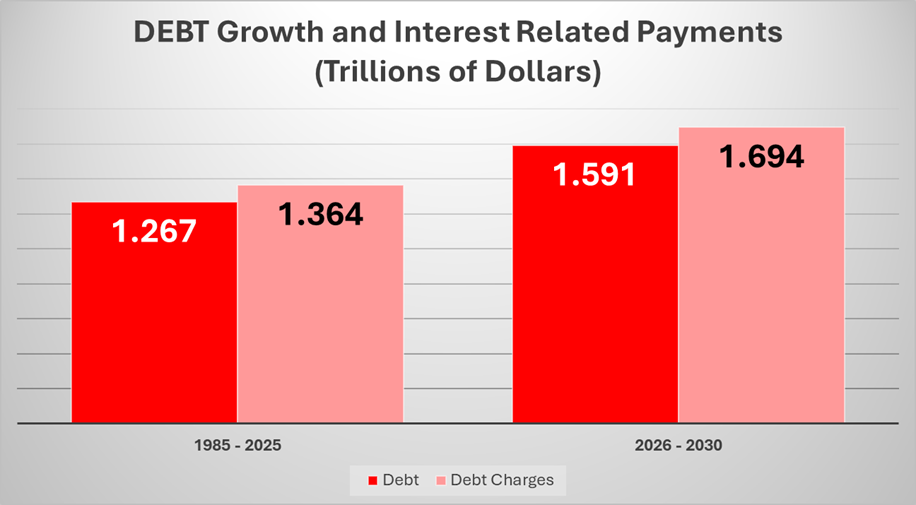

I identified that over the past 40 years Canada’s National Debt has grown from about $208 billion in 1985 to $1.27 trillion in 2025. And, according to the Carney government’s November 2025 federal budget, that Debt will climb to $1.59 trillion by 2030.

As a direct result of this unsustainable growth in Debt (debt that every single Canadian citizen is on-the-hook for) the Government of Canada pays billions of dollars in Interest annually to Creditors.

In 2025 alone, Interest Related Payments to creditors will be about $53.8 billion. As pointed out by the Fraser Institute, that payment will be greater than the approximate $52.1 billion in transfer payments to Canada´s provinces and territories in support of Healthcare Delivery. By 2030 the Carney government expects annual interest related payments to be a whopping $76.1 billion.

Three Visuals That Speak Trillions

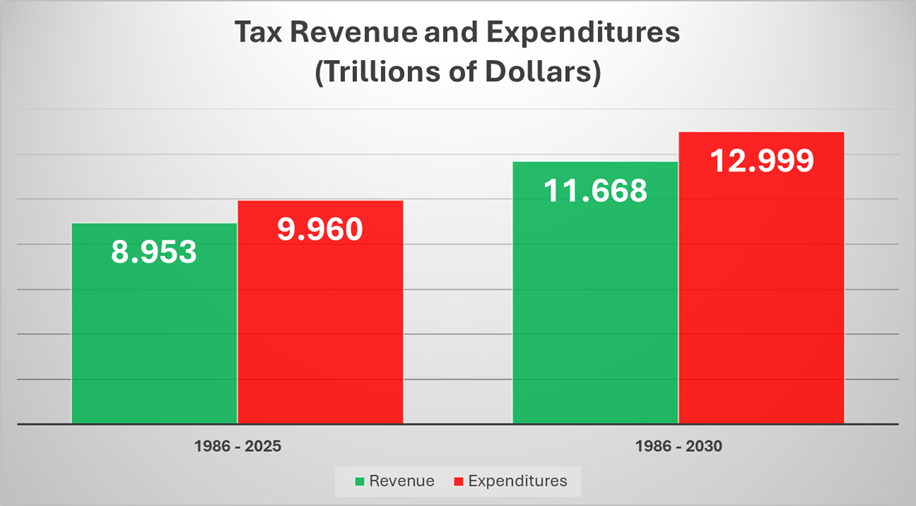

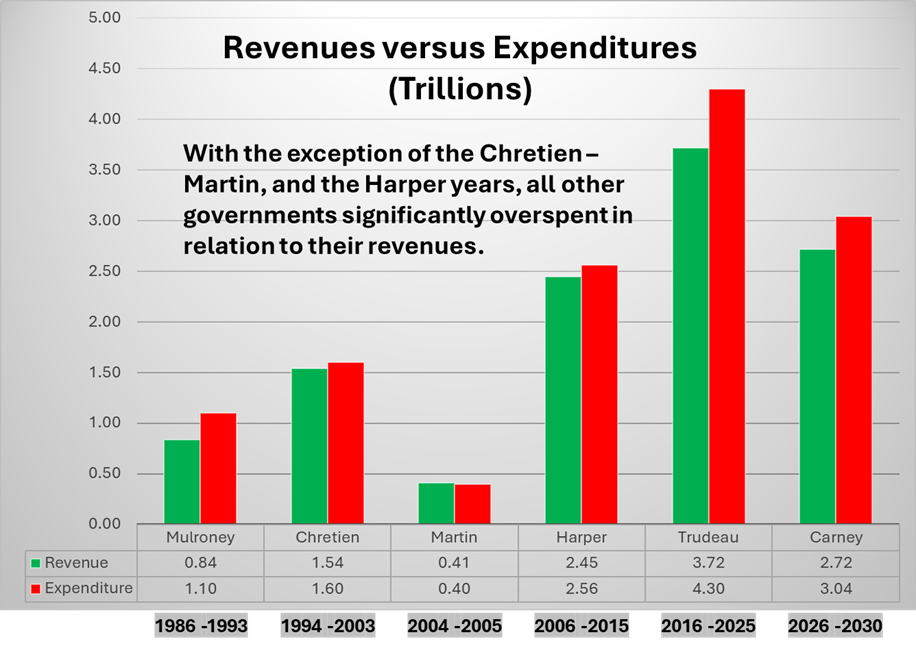

Now would be a good time to introduce a series of visual representing the evolution of government financial management from 1986 and 2030. For clarity, the numbers from 1986 to 2025 are real and the amounts from 2026 to 2030 are projected based on the Carney government´s November 2025 federal budget.

Takeaways From These Visuals

With respect to Figure 1: Successive governments since 1986 have and continue to spend more than what they take in with respect to revenues resulting in year-over-year Annual Deficits and an unsustainable growing National Debt.

For a certain segment of Canada´s voting population it is often assumed that Liberal governments are for tax and spend more, and Conservative governments are for fiscal prudence. Figure 2 makes clear that both Liberals and Conservatives are for tax and spend more.

For another segment of Canada´s voting population there is a belief that Deficits are only temporary and that their governments will pay it often very soon. Forty years of data would refute that view and make clear that Canada´s federal governments are addicted to incurring Annual Deficits and ballooning the National Debt.

That said, some credit needs to be given to the Chretien / Martin Liberal governments and the Harper government for at least attempting to match expenditures to revenues.

With respect to Figure 3: While mainstream media frequently mentions the size of Canada´s National Debt, they never seem to mention the Accumulated Interest Related Payments (commonly referred to as Debt Charge Payments these days) that successive governments between 1986 and 2025 have incurred in relation to servicing the country´s growing National Debt.

The epiphany one can take from the data in Figure 3 is that Canada´s Accumulated Interest Related Payments have exceeded the government´s total National Debt. Think about that for a minute or two!

A Debt Death Spiral of Our Own Making

In 2025 Canada incurred an Annual Deficit of approximately $36.4 billion and made Interest Related Payments to Creditors of about $53.4 billion. In 2030 the Carney expects to incur an Annual Deficit close to 56.6 billion and spend $76.1 billion to cover its Interest Related Obligations to Creditors.

One could take the view that the government is not only borrowing money to cover their excess program expenditures but also cover their Obligations to Creditors.

While I believe that the Carney government actually wants to address the out-of-control financial mess Canada is faced with, our country may have reached a point where it becomes impossible to escape a Debt – Interest Death Spiral without imposing major austerity that has the knock-on effect of inflicting horrendous damage to Canada´s quality of life.

As the saying goes ´you´re damned if you do and damned if you do not´.

In my next post I will delve deeper into the impact of how this Death Spiral will be felt by everyday Canadian citizens.

Click here if you would like to go to my next post:

How Federal Debt Impacts Provinces, Territories and Canadians

We must get to a place where our Expenditures match our Revenues

without Deficit Financing!

If you have not done so already, please review my Legal Stuff page.